Working capital cycle

- difference between firm paying for cash for costs and its costs for production

- Also called net current assets or circulating capital ⇒ working capital

- cash available to a business for daily operations Current assets - short term business belongings that are easy to turn into cash (see 3.4 Finance Accounts)

- Cash

- Stock

- Debtors Current liabilities - short term loans

- Bank overdrafts (take more money than in their bank account. Short term and high interest)

- Trade creditors (usually suppliers, buy now pay later)

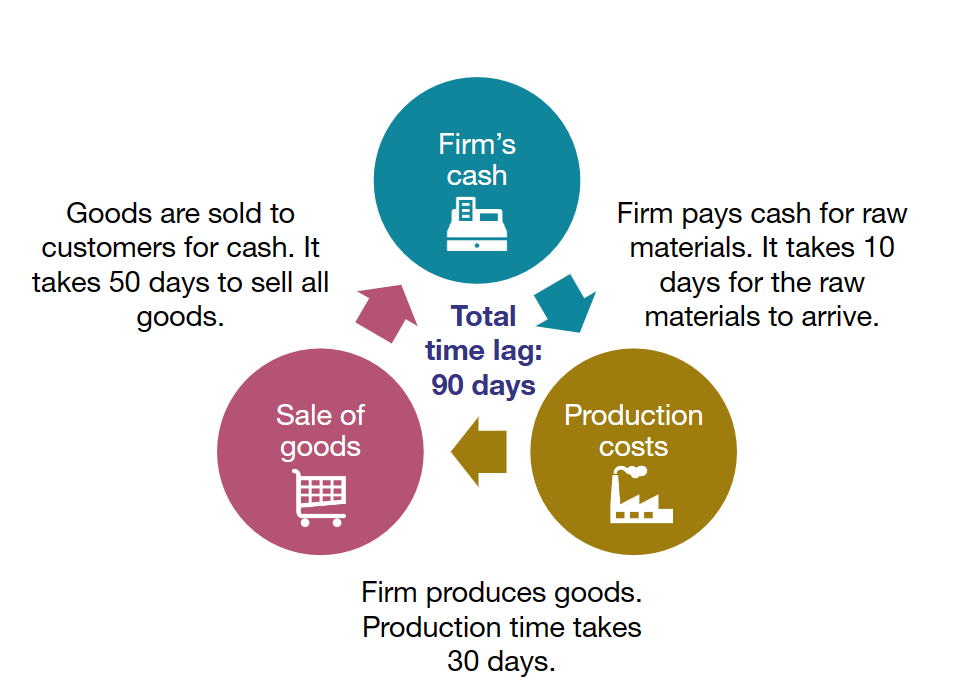

- Short term loans Working capital cycle: time elapsed between organization paying for production of product/service, and receiving cash from the customer

- Leasing a vehicle has a long working capital cycle, for example (DOES IT THOUGH)