- tells you how well the resources of a business are used to generate income from capital

- organization’s resources in terms of liabilities and assets

- HOW WELL YOUR COMPANY USES financial resources (i.e. make money with money?) 4 types of efficiency ratios

- stock turnover ratio (or inventory turnover ratio)

- debtor days ratio

- creditor days ratio

- gearing ratio

Why are efficiency ratios important

- helps manage inventory (make sure you have enough in stock for a predicted demand)

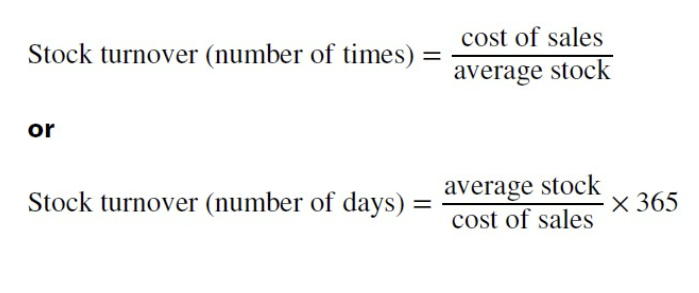

Stock turnover ratio

- tells you how quickly a company sells its inventory

Calculate average stock:

Calculate average stock: - grocery stores want a high turnover rate (because they can’t sell rotting food)

How to improve your stock ratio

- Get rid of obsolete inventory

- Sell less products (easier to maintain a shorter product list, better for management)

- Use Just in Time manufacturing

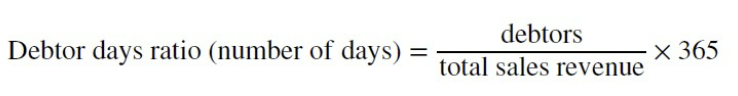

Debtor days ratio

- measures how long it takes for a business to get debts from their customers (i.e. they bought goods on credit)

- Goal with debtor days ratio: you want to maintain cash flow and cash liquidity

- The lower the debtors ratio, the better (means if the debt isn’t paid you don’t go bankrupt)

Improve debtors day ratio

- you don’t want a high debtors day ratio ⇒ means you’re getting a lot of credit sales. So, you want to get paid earlier or allow less customer to pay with credit

- Incentivize customers to pay with cash rather than credit (i.e. give cash discount)

- shorten the credit period to customers (so they have to pay quicker)

- Stricter criteria for which customers qualify to pay on credit

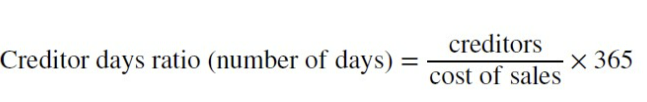

Creditor days ratio

- like debtors day but in reverse

- measures the time it takes for a company to pay it’s loans (i.e. the business uses trade credits to purchase products)

- credit days ratio are important: the longer you wait to pay a loan, the more interest you accrue. Which is bad.

- Improve credit days ratio:

- “negotiate an extended credit period with the firm’s supplier’s"

- "Looking for different suppliers who prefer preferential trade credit agreements”

- what is preferential trade credit agreement?

- ”Use cash for inventories (cost of sales) instead of over-relying on trade credit”

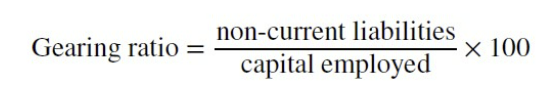

Gearing ratio

- tells you to what extent an organization is externally funded

- non-current liabilities: loan capital

- capital employed: sum of non-current liabilities and equity Gearing ratio can tell you if you are in a good position to take on debt

- high gearing ratio: if interest rates increase you’re screwed, so don’t take more loans

- you’re going to have to pay higher loan interest payments (new debt + old debt)

How to improve your gearing ratio

- Pay off long term liabilities (loan capitals)

- Increase the firm’s working capital (increase cash flow? make debtors pay quicker)

- Rely on or increase the use of internal finances (since external finance gets loans)

Watch this video perhaps: https://youtu.be/UuahUYKvV1k