Ratio analysis: a way to analyse the financial performance of a business. Three things:

- Gross profit margin

- Profit margin

- Return on capital employed (ROCE)

- Net profit: gross profit - overhead costs

- You want a high gpm

- How to get a higher GPM:

- Increase sales revenue and reduce direct costs

- i.e. launching products with higher gross profit margin

- Reduce price of product and sell at a higher volume

- Outsource production to places where labour is cheap Profit margin ratio: Profit: financial surplus after the payment of all overhead costs. How to increase profit margin: reduce overhead costs

- Increase sales revenue and reduce direct costs

- Insurance, lease payments, mortgage payments, phone+internet, rent, salaries for cost centers, utility bills

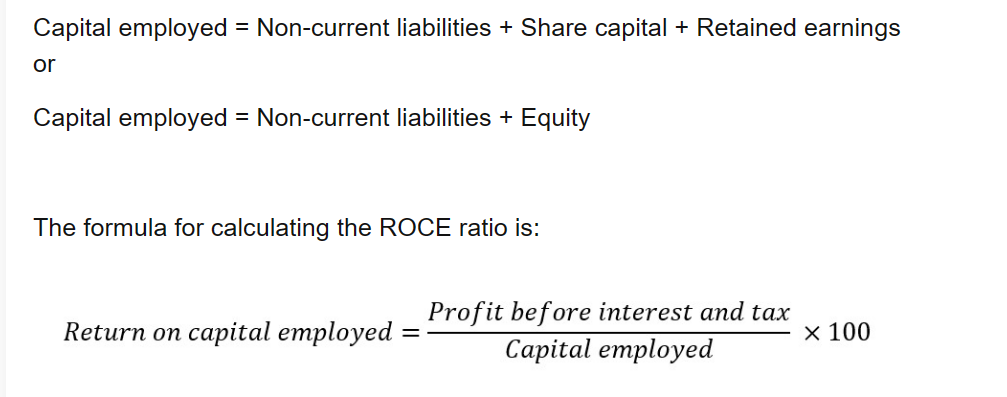

Return on capital employed

Return on capital employed- Measures the profitability when compared to its size (value of employed capital)

- how much money you get for the capital expenditure in a product (kind of)

- How to improve ROCE:

- increase sales revenue

- Reduce cost of production

- Sell unproductive, unused, underused, and obsolete assets (to improve operational efficiency) Non-current liabilities: long term debts of an organization that’s raised through loan capital (such as mortgages and long term borrowing)