PBP - payback period. Time it takes to pay for investment using gains from investment ARR - average annual profit expressed in percentage of initial investment

PAYBACK PERIOD

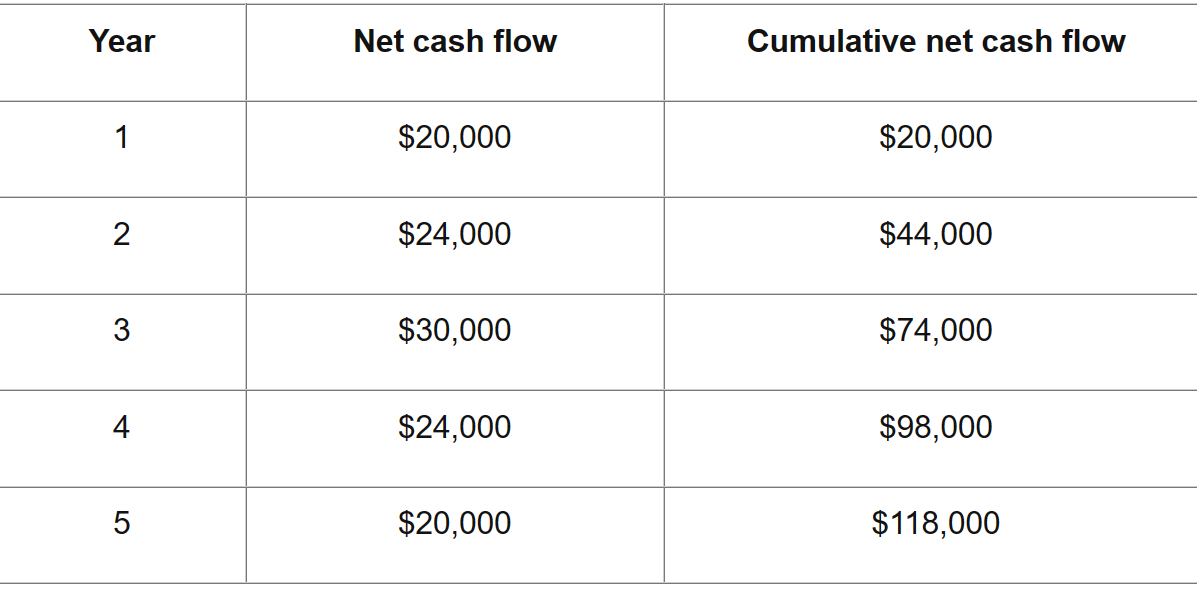

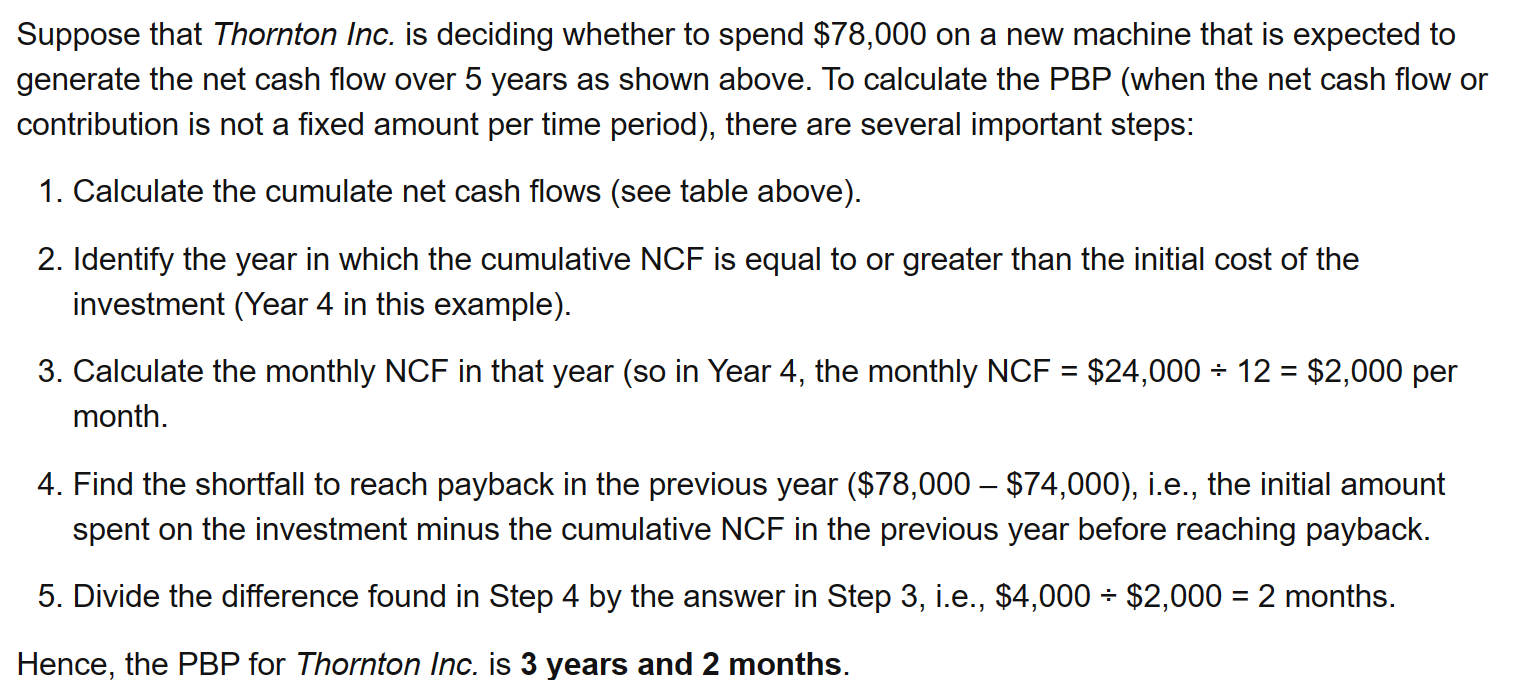

Use cumulative net cash flow

Advantages of the payback period

- easiest and fastest method to calculate investment appraisal

- Easy to understand

- help businesses survive recessions

- Good for fast changing industries, new products and trends become outdated quickly

- aids in decision making

Disadvantages

- doesn’t account for deflation

- not good for long term projects with long payback periods

- useful life of investment is not considered by the payback period

- PBP doesn’t tell you info about the profitability of an investment long term

do 3.8 dynamic quiz in ARR

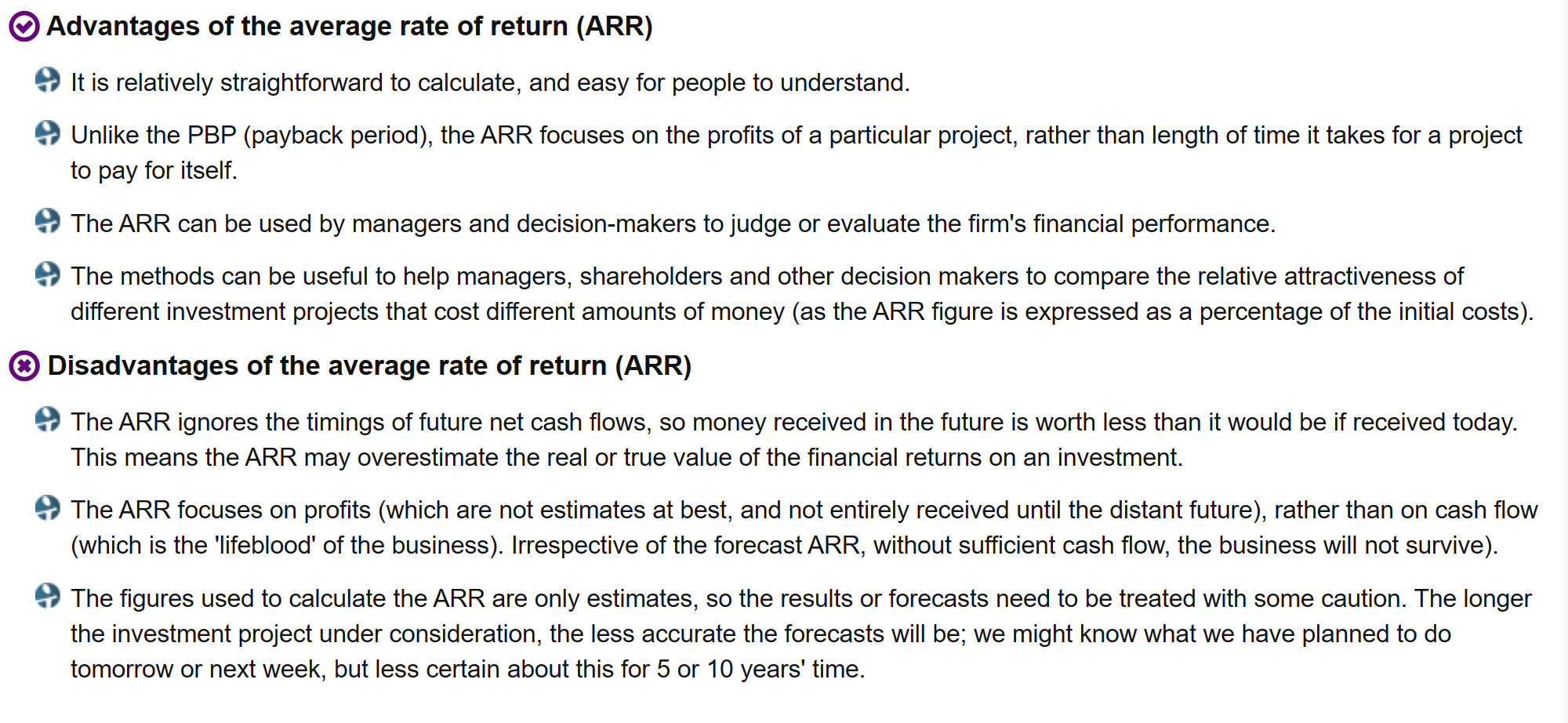

- the higher the ARR, the more money per annum you get out of your investment. High ARR means happy managers

- Also kind of sad, high ARR means high interest rates (because you need loan to pay for investment)